Key Takeaways

- Pittsburgh City Council has approved a 20% property tax hike for next year, which is likely to move forward despite requiring Mayor Ed Gainey’s review.

- The tax hike is the second to hit Pittsburgh residents in a week, following a 2% tax increase approved by Pittsburgh Public Schools.

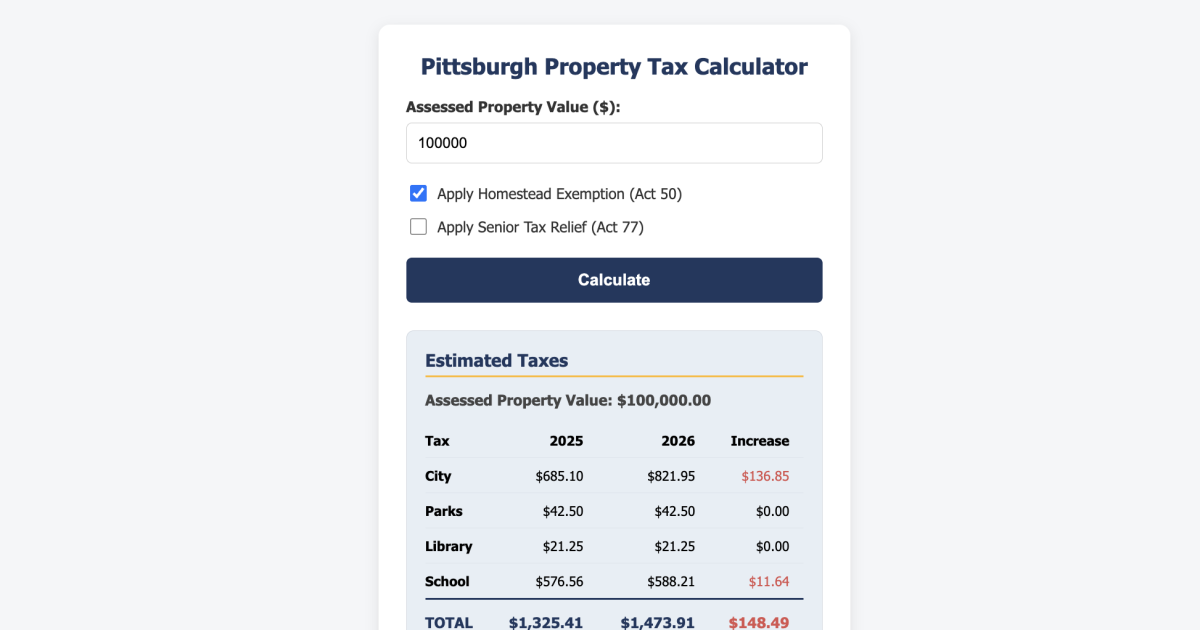

- A calculator has been created to help residents estimate their 2026 property taxes based on their assessed property value and available exemptions.

- The calculator takes into account the new millage rates for the city, schools, parks, and library, as well as exemptions such as the Homestead Tax Exemption and Senior Tax Relief.

Introduction to the Property Tax Hike

The city of Pittsburgh has recently approved a significant property tax hike, with a 20% increase set to take effect next year. This move comes after Pittsburgh Public Schools approved a 2% tax increase as part of its 2026 budget. The tax hike has left many city residents wondering what their local property taxes will be next year. To help residents estimate their taxes, a simple calculator has been created. The calculator uses the new millage rates for the city, schools, parks, and library, as well as available exemptions, to provide an estimate of 2026 property taxes.

Understanding the Calculator and Property Taxes

To use the calculator, residents need to look up their address on the Allegheny County Real Estate website and find their 2026 Full Base Year Market Value (Projected). This value is then entered into the calculator, along with any applicable exemptions, such as the Homestead Tax Exemption or Senior Tax Relief. The calculator then estimates the resident’s 2026 property taxes based on the new millage rates. The millage rates are used to determine the amount of property taxes owed, with each rate representing the amount of tax owed per $1,000 of assessed property value. For example, the new millage rate for Pittsburgh Public Schools is 10.457, which is equivalent to a 1.0457% tax rate.

How Property Taxes and Millage Rates Work

Property taxes in the city of Pittsburgh are determined by four city-level entities: the city itself, Pittsburgh Public Schools, the parks system, and the Carnegie Library of Pittsburgh system. Each entity has its own millage rate, which is used to calculate the amount of property taxes owed. The millage rates are often confusing, but they can be translated into a percentage of the assessed property value. For example, a 10.457 millage rate is equivalent to a 1.0457% tax rate. This means that for every $1,000 of assessed property value, the homeowner would owe $10.457 in property taxes to Pittsburgh Public Schools. The same calculation applies to the city, parks, and library taxes.

City Tax Exemptions and Discounts

Pittsburgh residents have several options to reduce their property taxes, including the Homestead Tax Exemption and Senior Tax Relief. The Homestead Tax Exemption is available to owner-occupied buildings and reduces the total assessed value of the property, resulting in lower taxes. The exemption is $15,000 for city, parks, and library taxes, and $43,750 for school district taxes. Senior Tax Relief, on the other hand, reduces a home’s tax assessment by 40% for lower-income seniors. Additionally, residents who pay their property taxes by February 10 can receive a 2% discount.

Conclusion and Next Steps

The recent property tax hike in Pittsburgh has left many residents wondering what their local property taxes will be next year. The calculator created to estimate 2026 property taxes takes into account the new millage rates and available exemptions. Residents can use the calculator to estimate their taxes and plan accordingly. It is essential for residents to understand how property taxes and millage rates work, as well as the available exemptions and discounts, to minimize their tax liability. By using the calculator and taking advantage of available exemptions, residents can better prepare for the upcoming tax year.